Your ultimate complete guide of using PayPal in the Philippines is here. You will learn how to open and create a PayPal account and receive and withdraw funds from PayPal to any Philippine bank account on this page.

PayPal is among the most trusted and most reliable online payment platforms in the world today. We can use it to shop online, even without an existing credit card. PayPal is a necessity not only for shopping online and transferring money to anyone around the world.

Having a PayPal account is also a primary requirement to receive income, commissions, and salaries earned from online jobs and freelance work anywhere across the globe.

It’s so easy to set up and open a PayPal account. It’s worth mentioning that it costs nothing to open an account. All you have to do is follow the steps and guides below, and you are ready to receive and transfer money online.

Table of Contents:

PayPal is an open digital and mobile payment platform that enables consumers and merchants to receive money in more than 100 currencies, withdraw funds in 56 currencies and hold balances in their accounts in 25 currencies. Currently, Paypal serves over 325 million active account holders globally.

All your important information like name, address, and birth date must match on all your IDs, bank accounts, documents, and PayPal to avoid account limits.

On your internet browser, visit paypal.com and tap the SIGN UP button if it is your first time using PayPal. You can use your desktop, laptop, tablet, or mobile phone as long as you have a steady internet connection.

Before signing up, we recommend you prepare your active email address and list down your PayPal login credentials (username and password) so that you won’t forget them in the future. Since PayPal is an essential account, make sure you prepare a strong password.

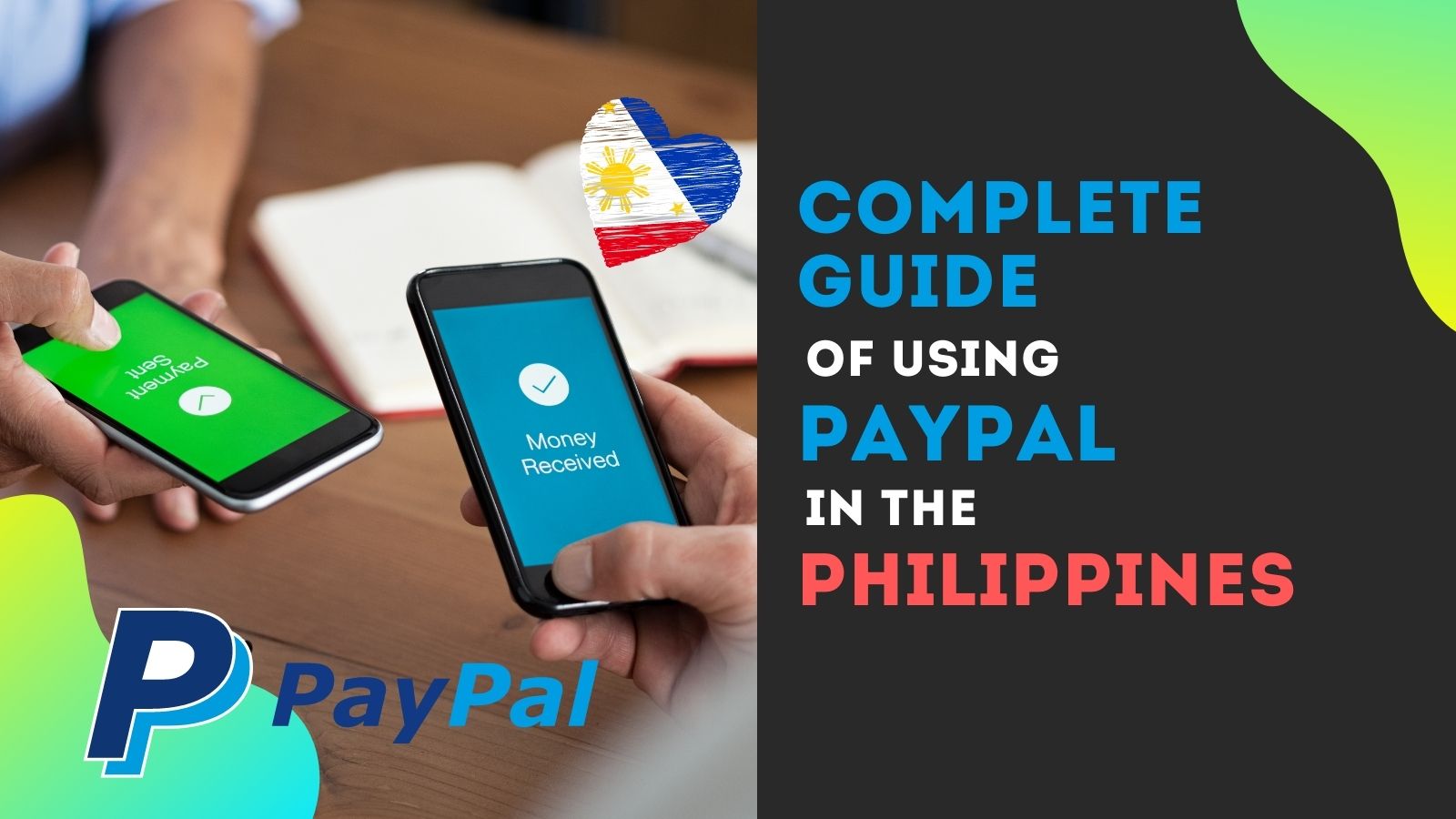

PayPal offers two types of accounts: Personal and Business accounts.

Personal Account is the primary account has the following features:

Business Account is used for Official Businesses and has the following features:

For this example, we are opening PayPal Personal Account, select it and indicate whether you are an online shopper, individual seller, and freelancer, or both. Otherwise, indicate if you are not sure about that. Click the NEXT button to proceed.

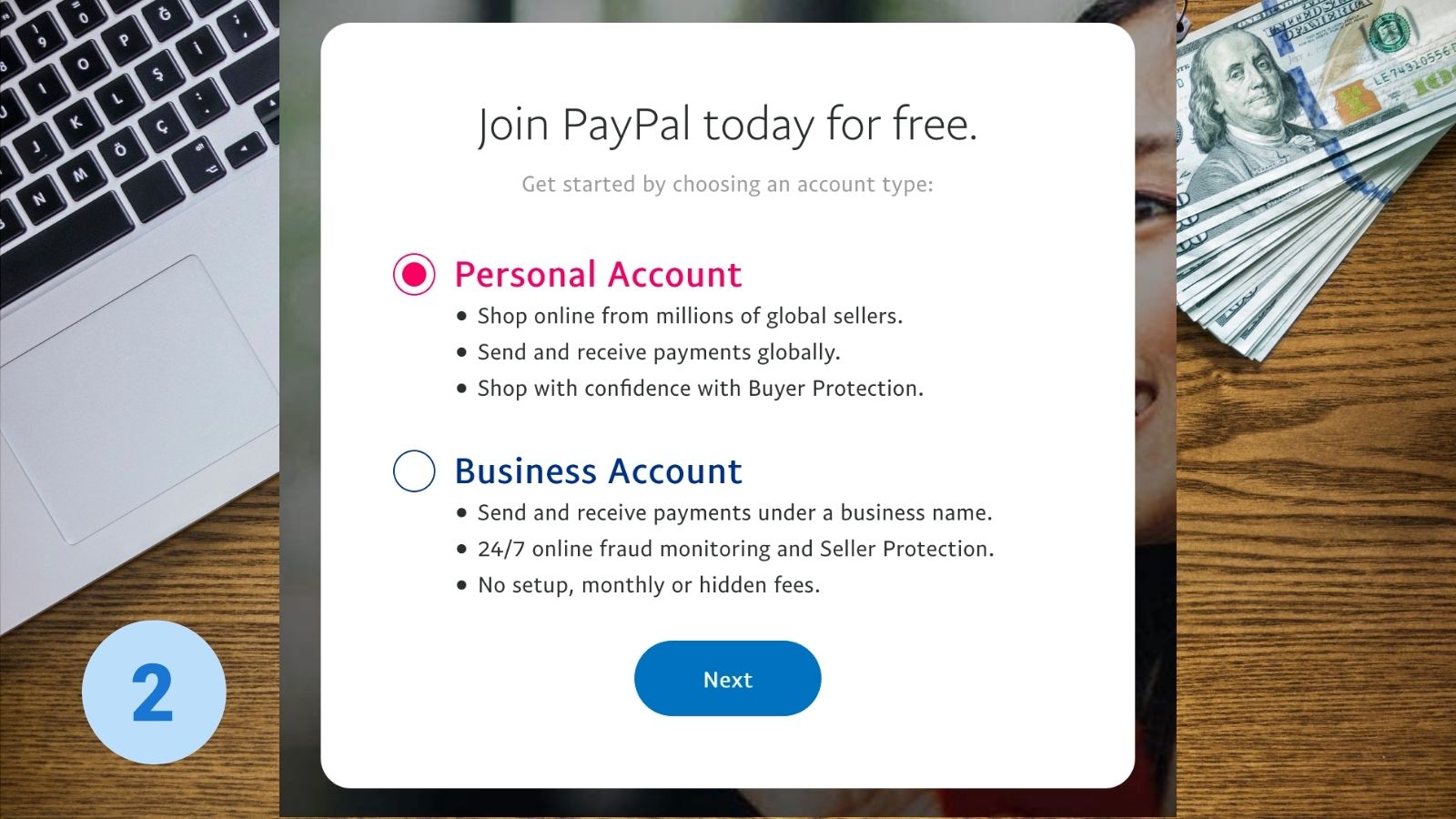

Enter your correct information on the field provided. That includes your active email address, mobile number, first name, middle name, last name, and your preferred password. You must give only true and correct details here.

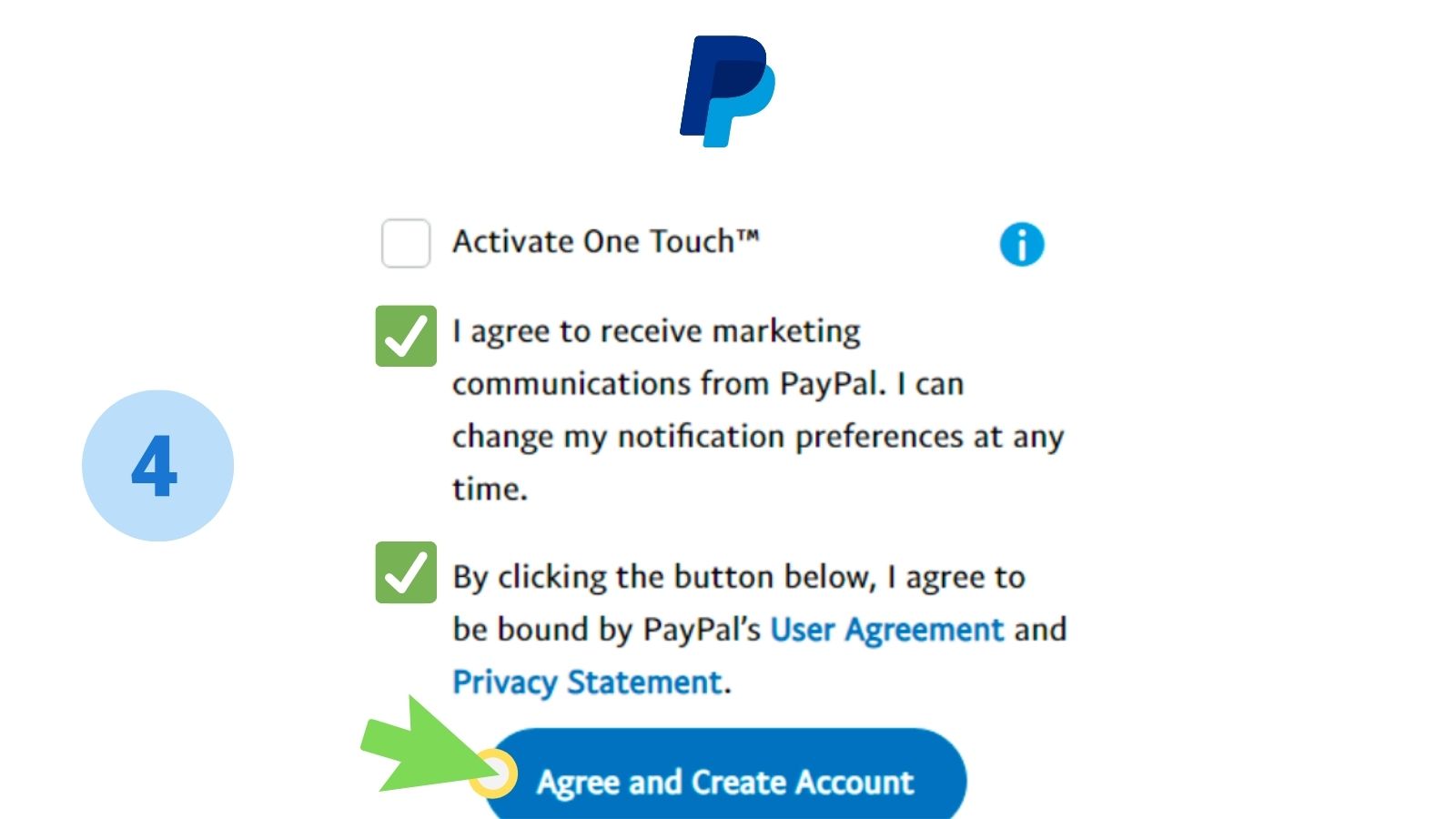

You will be given an option to activate One Touch, a feature in PayPal that allows you to check out faster without logging in or filling out your billing information. You may skip that feature if you want to activate it later.

Confirm that you agree with PayPal’s User Agreement and Privacy Statement to proceed to the next step.

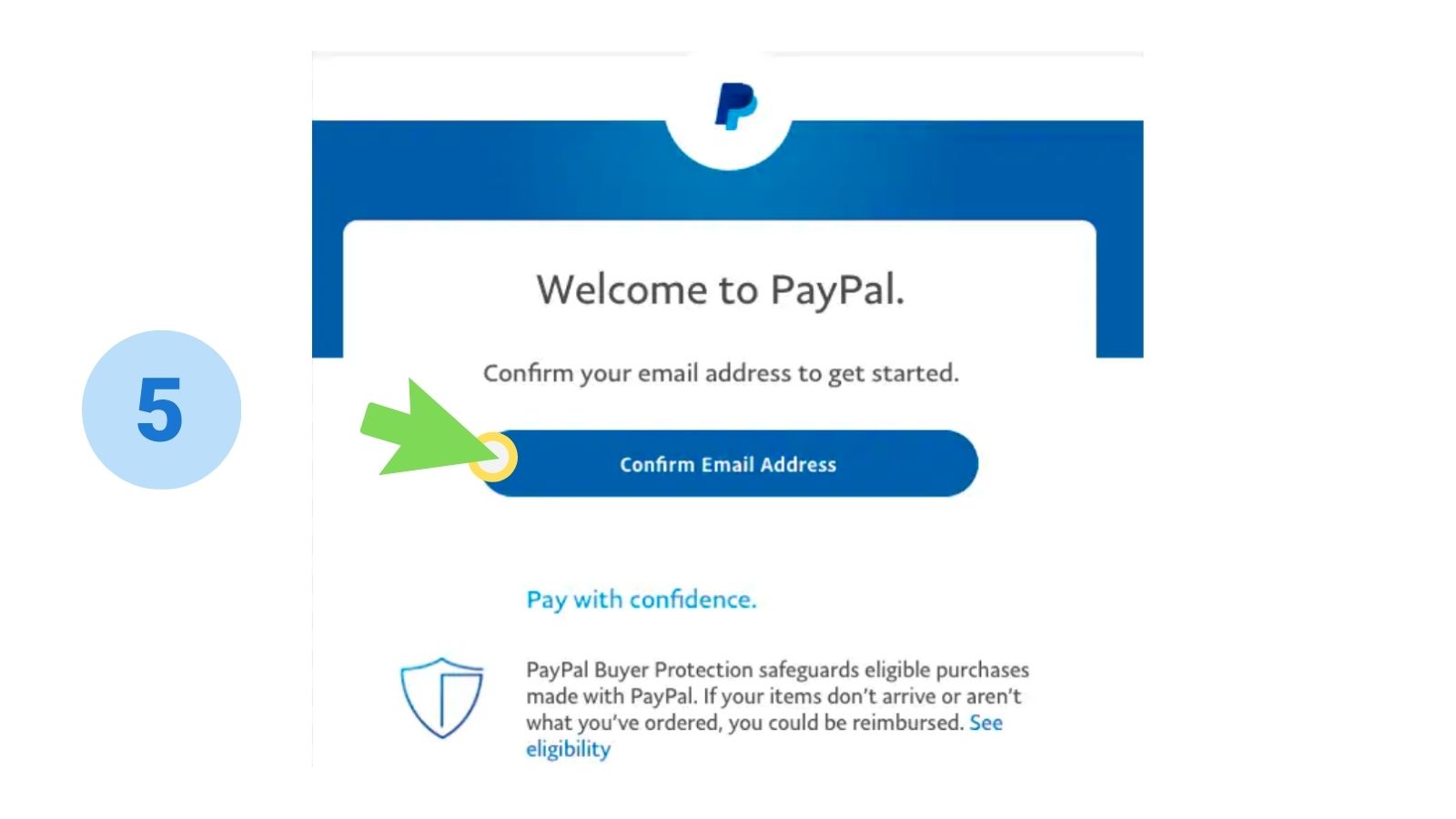

Open your email and look for the email notification from PayPal. You have to confirm your email address so that PayPal can verify your identity. Then you can start using your PayPal account.

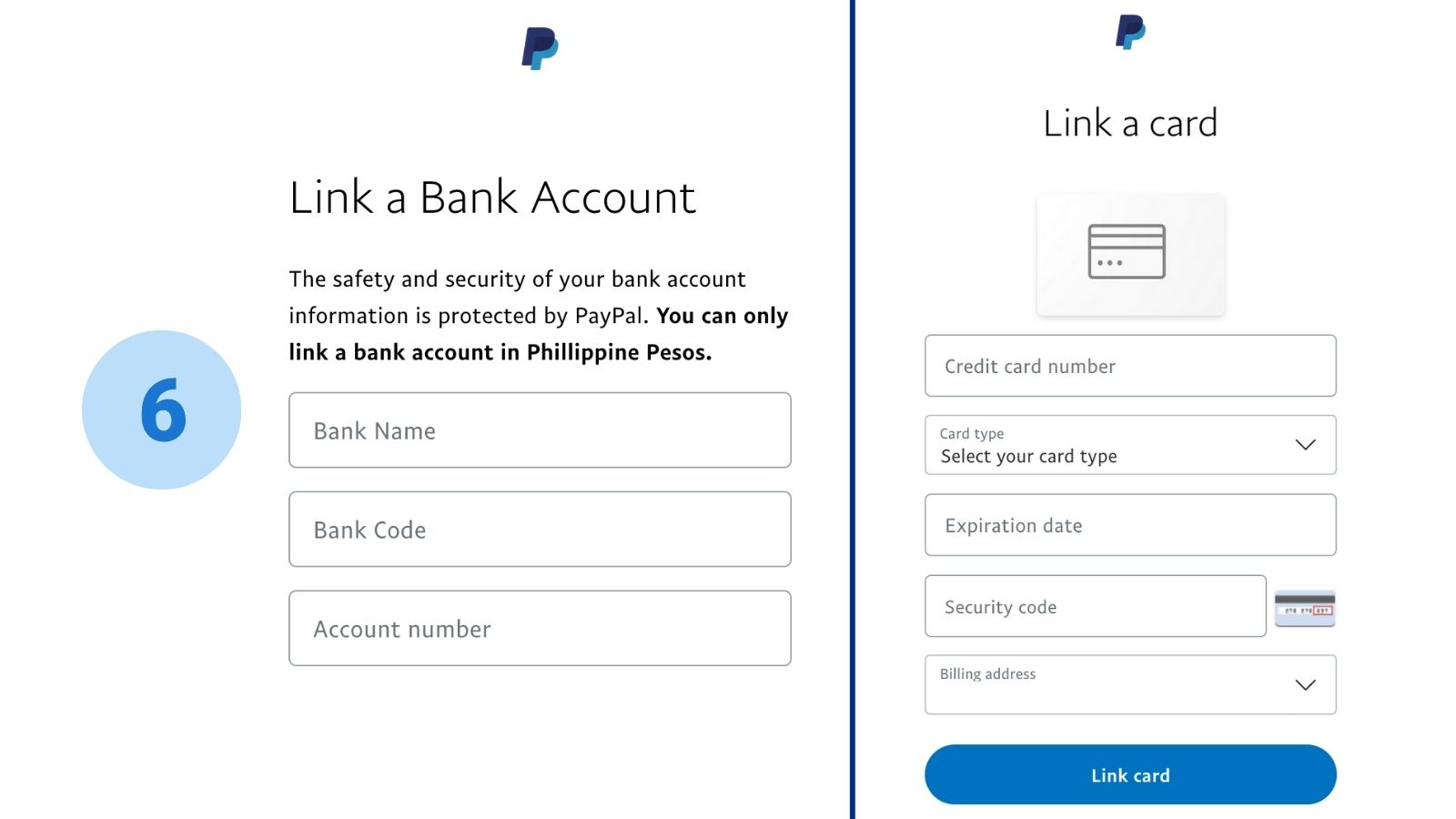

To fully use all the features of PayPal, you need to link any of your existing bank accounts to PayPal. You can use your regular savings or deposit account in the Philippines or any current debit card and credit card (Visa, MasterCard, American Express, Discover, Union Pay).

To link a regular deposit and savings account to PayPal, select “Link a New Bank Account” from the menu or your profile settings. Provide the name of your bank. The bank code will automatically load. Indicate your account number.

To link a debit card or credit card to your PayPal account, select “Link a New Card” from the menu tab or your profile settings. Type in your card number, choose your card’s type, indicate its expiration date and security code. Your billing address must match with your card account details.

In addition, you can also link your GCash and PayMaya account to PayPal. The complete instructions to do that are listed below.

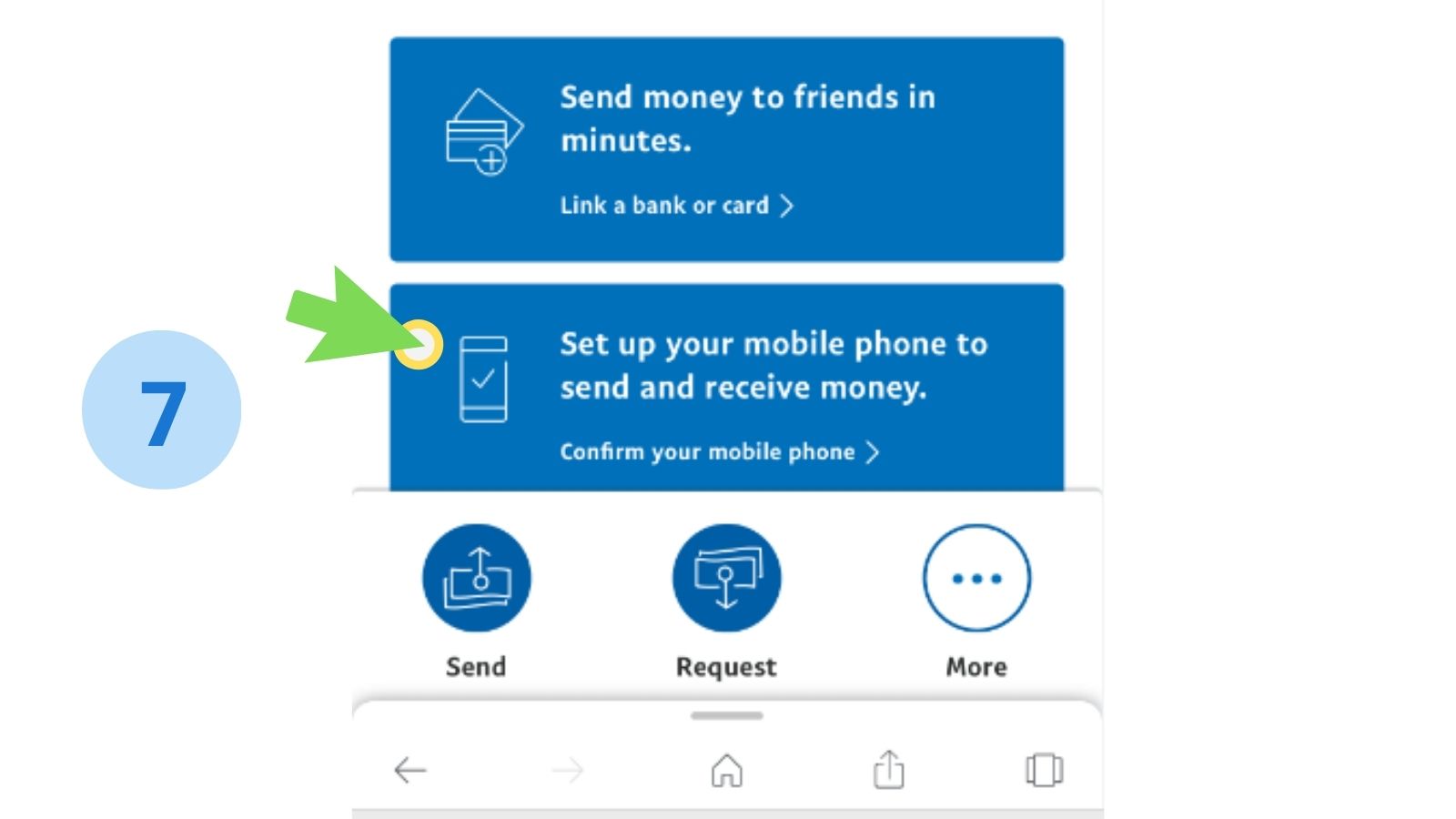

Mobile number confirmation is another layer of account protection and security feature. PayPal will send a security code to your mobile number. Type in the code to confirm your ownership.

That being said, make sure you have entered a correct mobile number upon signing up and make sure your smartphone is within a strong network signal.

Verifying PayPal account is a must, especially for newbies and beginners, because PayPal is one of the most secure ways to pay and get paid online. If your PayPal account has sending and withdrawing limits, you need to verify it by logging in and clicking the Get Verified tab found in your account or profile overview page.

If you don’t have any existing bank account and a credit card at present, and you would like to open and activate a PayPal account, you can still do it by opening a PayMaya account.

If your account has a decent cash balance of P100 or more, you can upgrade it and get a free Online Payment Card. You can then link that card to PayPal to verify your PayPal account.

Another way of opening a PayPal account without a credit card or bank account is using Payoneer. If you are a student or a freelance worker, Payoneer is an alternative way to use and link PayPal.

To learn more how to link PayMaya to Paypal, follow the procedures below.

PayMaya is another online payment app in the Philippines used to send and receive money. May Filipinos also depend on PayMaya for fast and secure bills payment transactions.

PayMaya can also be linked and be used to verify PayPal account. Ensure your PayMaya account has an existing cash balance of P100 or more, as PayPal will charge a fee for the verification. No worries, though, because this fee will be refunded back to your PayMaya cash balance.

GCash is one of the most reliable mobile payment apps in the Philippines. It is a virtual wallet you can use to pay and receive money in the Philippines. Before you can link your PayPal account to GCash, make sure your GCash account has a decent cash balance and is fully verified.

Up to 20 people can pay you back, even if they don’t have a PayPal account. Just use their email or mobile number to request payment.